Girl Math and the Magic of the Little Treats Fund

First, let’s talk about the high-yield savings account, or the HYSA. The interest from this account will make up the Little Treats Fund.

A HYSA is simply a type of savings account that offers an interest rate significantly higher than a standard savings account. The main selling point of a HYSA is the higher annual percentage yield (APY), often 10 to 20 times higher than what you'd get in a traditional savings account. Rates can vary, but they typically range from 3% to 5% annually. A traditional savings account usually offers an APY of only 0.01% to 0.05%.

Like regular savings accounts, HYSAs are usually insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank. This means your money is protected even if the bank fails. The accounts are low-risk because your money is not subject to market fluctuations. You are guaranteed the interest rate, and your balance is insured.

Many of the best high-yield savings accounts are offered by online banks. Two really solid options are Marcus by Goldman Sachs and Ally Bank. Neither have monthly fees (side note: never use a bank with a monthly fee—there are plenty of excellent checking and savings accounts offered by banks with $0 in monthly fees—use one of those).

A HYSA is a good option for your emergency fund or short-term savings while earning more interest than in a regular savings account.

Now to the Little Treats Fund…

The Little Treats Fund is the monthly interest you receive from your HYSA!

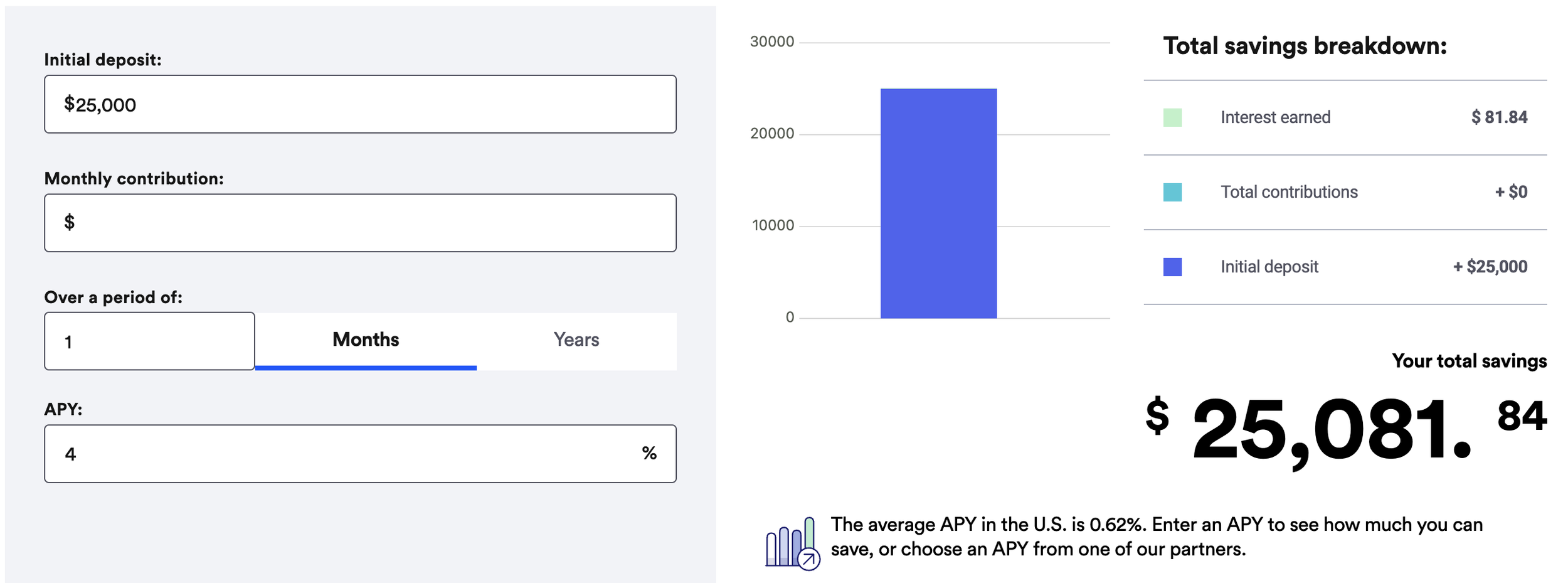

For example, if you have $25,000 saved in a HYSA with a 4% APY, you will make about $80 a month on that money without contributing any extra money.

That $80 is the Little Treats Fund, a sacred fund to be spent only on fun stuff. Your Little Treats Fund will vary depending on how much you have saved in your HYSA, but if you have a solid plan in place for spending, saving, and investing already, I encourage you to have some fun with the interest you earn in your savings account, especially if you aren’t much of a spender naturally. If you are frugal, this could be a good way to actually get yourself to spend a little money on the things you enjoy and not feel guilty about it.

I like to use my Little Treats and Fundto purchase oat milk lattes when I’m out and about. And because the Little Treats Fundis money from interest (i.e. I didn’t have to work for it), girl math tells me those lattes are basically free. Everyone loves a free latte.

Thank you for visiting the Exploring Financial Freedom Blog.

Thank you for taking the time to read our blog, where we strive to provide insightful financial tips and life advice tailored to help you navigate your journey towards financial freedom. Your engagement is invaluable, and we hope that the knowledge shared here empowers you to make informed decisions. We are committed to being a resource that supports your aspirations and guides you through the complexities of personal finance.